Transaction continues Realterm’s momentum in credit space

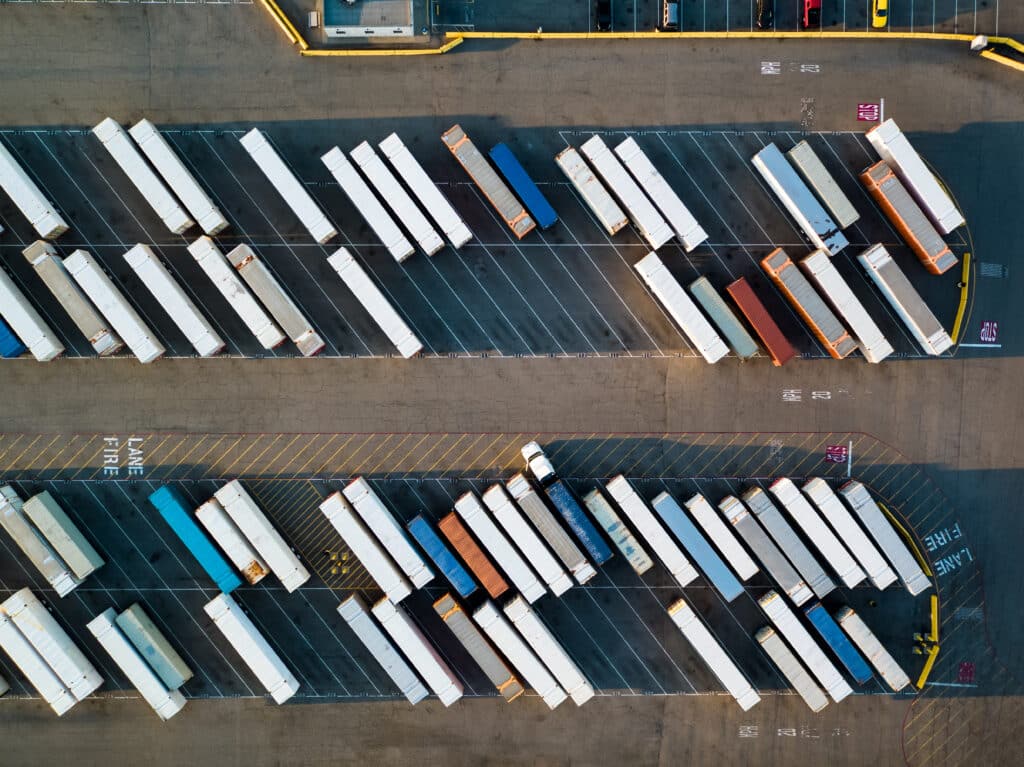

Annapolis, Md. (January 28, 2026) – Realterm, an independent global investment manager focused on the transportation industry, today announced it has originated a $43.5 million loan to refinance a fully leased 10-property IOS portfolio in Atlanta, Georgia and Charleston, South Carolina.

With nine properties in Atlanta and one in Charleston, the portfolio of IOS assets all offer ample access and connectivity to the surrounding metropolitan areas.

“As we continue to scale our credit platform, transactions like this multi-property financing showcase our capability to deliver institutional-quality execution,” said Paul Sisson, Head of Credit, Realterm. “The drumbeat of deals across Realterm’s growing business line proves the market’s continued confidence in our niche expertise.”

Realterm’s strategic expansion into credit space continues its momentum with this financing, leveraging the company’s decades of expertise in the transportation logistics and industrial sectors to provide funding solutions for its clients. With traditional bank lending channels constrained, Realterm’s lending platform fills critical financing gaps, offering borrowers the advantage of working with a lender who understands industrial real estate assets.