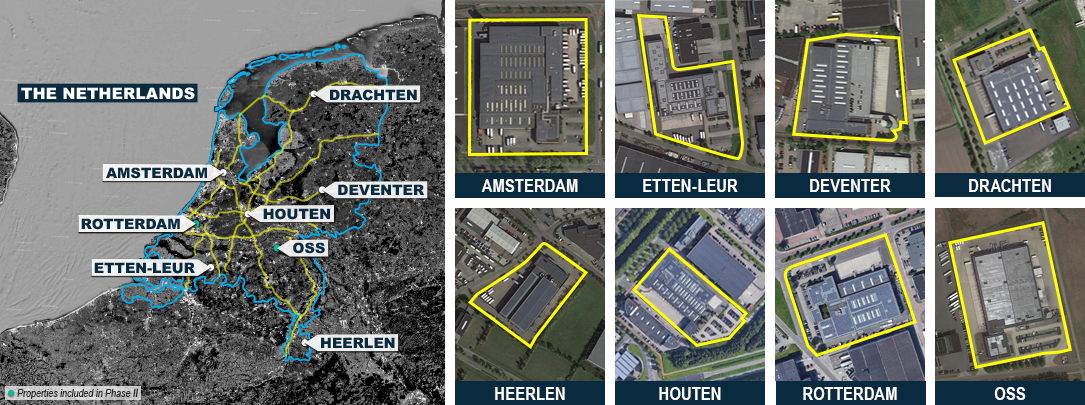

Realterm is pleased to announce the acquisition of Phase II of an eight property, highly functional high flow-through (HFT) portfolio located in the Netherlands. The final two assets in the portfolio acquisition are located in Rotterdam and Oss. All eight assets are available immediately for lease.

“This high-quality portfolio was designed to service the Dutch direct-to-consumer network of a global beverage company and has never been available on the leasing market before,” said Balazs Lados, Managing Director. “This is an incredible leasing opportunity for a wide range of users including final mile, transload, e-commerce, parcel, local and regional distribution.”

All eight properties have a low footprint and a high number of loading positions. The yards are fenced, secure, lit and provide sufficient parking. Future tenants will benefit from sustainable energy produced by roof installed solar panels.

Highlights of the Rotterdam asset include:

- 15 loading positions

- 8,335 sqm of lettable area

- 15,564 sqm site area

- Low site coverage allowing for ample parking

Highlights of the Oss asset include:

- 29 loading positions

- 31 doors

- 11,010 sqm of lettable area

- 28,501 sqm site area

- Highly functional cross dock with ample room for parking

Colliers represented the seller and Savills represented Realterm in the transaction.

For more details on leasing opportunities, click here.