Logistics real estate leader expands into direct lending capital solutions to address financing gap in industrial sector

Annapolis, Md. (September 3, 2025) – Realterm, a global logistics investment manager, announced today the successful closing of its inaugural Realterm Logistics Credit Fund (RLCF) and co-investment vehicle with $350 million in aggregate capital commitments. This marks Realterm’s strategic expansion into direct lending capital solutions for the industrial and logistics sector, including transportation-advantaged industrial outdoor storage properties.

“We will construct a highly granular portfolio of privately negotiated senior mortgages and junior capital solutions, targeting both stabilized and transitional logistics properties across major U.S. markets,” said Paul Sisson, Head of Credit at Realterm and RLCF Fund Manager. “We’re leveraging our three decades of investment expertise as a sector specialist to provide sophisticated and creative lending solutions to fill a financing gap that is underserved by traditional lenders.”

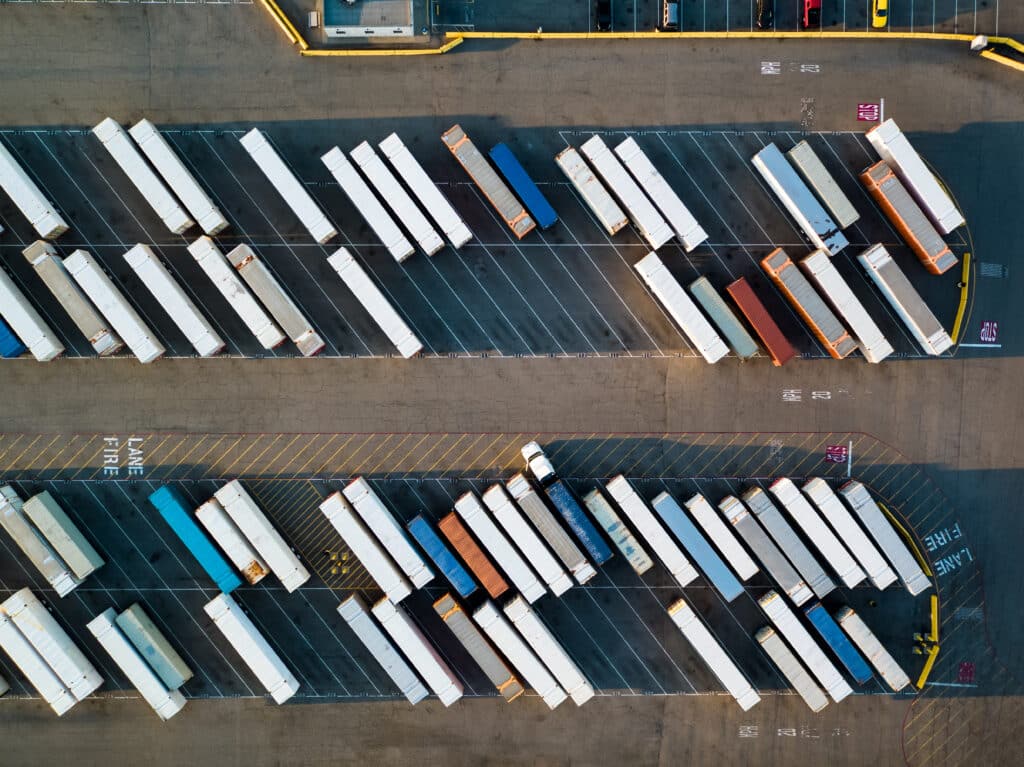

The U.S. industrial and logistics sector has nearly tripled in size and more than doubled as a percentage of the total real estate sector since 2008, creating substantial demand for specialized financing solutions. However, traditional lenders have struggled to serve this market due to smaller average loan sizes and unfamiliarity with specialized industrial property types like industrial outdoor storage, leaving borrowers underserved despite historically strong operating fundamentals.

“The successful closing of Realterm’s first credit fund represents a natural evolution of our platform and extension of our sector expertise into a new asset class, which will further enhance the range of capital solutions that we can offer to our counterparties,” said Peter Lesburg, Managing Director, and Realterm’s Global Head of Capital Markets. “We are also excited to welcome several new investors into our partnership through this new vehicle.”

RLCF has already closed its first loan at $70 million to finance a national portfolio of industrial outdoor storage properties.