April 9, 2020 – Realterm is pleased to announce the successful closing of Realterm Europe Logistics Fund (RELF) at its hard cap of €100 million to invest in the high flow through (HFT) logistics real estate sector in Europe. RELF is the ninth fund raised across the Realterm platform and the firm’s first value-added fund in Europe.

“Our successful fundraise is a testament to the team that we have built and our investors’ belief in our ability to create value through our differentiated investment approach and market insights,” said Peter Lesburg, Realterm’s Managing Director of Capital Markets.

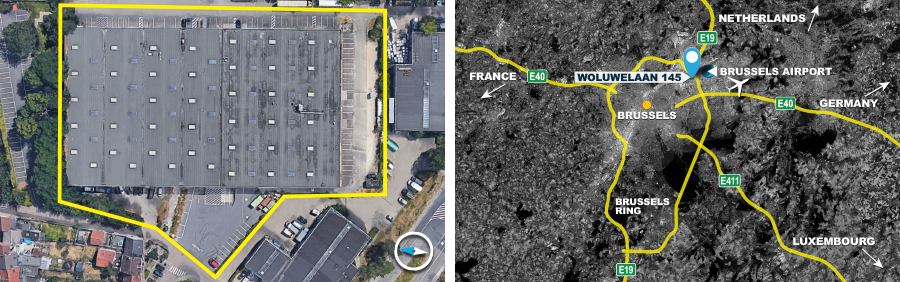

RELF’s first investment is a 10,000 sqm (107,600 sf) HFT facility fully leased to DHL at the intersection of two key pan-European transport corridors – E40 and E19 in Brussels, Belgium. The property has an infill location with close proximity to Brussels Airport, the Benelux ports and a dense residential population.

“The exceptional location, functionality and access to both transportation infrastructure and a large consumer base make this a great first addition to the portfolio,” said Balazs Lados, Managing Director for Realterm Europe and Fund Manager for RELF. “The property is suitable for a wide variety of operations, including air cargo, e-fulfilment, regional distribution and last mile delivery. We are excited to welcome DHL as our first customer in Europe.”

HFT properties typically facilitate a change in transportation mode and include cross-dock truck terminals, transload and related trans-shipment, air cargo, parcel sortation, final mile warehouses and other e-commerce backbone facilities. Strategically located in and around major population centers, primary distribution hubs and along major pan-European freight corridors, transportation-advantaged HFT facilities are the critical high-volume transfer points facilitating the efficient flow of goods through the supply chain.

Read Private Equity Real Estate’s (PERE) exclusive story on Realterm here.

About Realterm

Realterm is a real estate operator with a 30-year track record of executing niche private equity strategies at the intersection of the global supply chain and evolving consumption trends. Realterm currently manages over $5 billion in assets through five logistics-oriented private equity fund series: Realterm Airport Logistics Properties (RALP), an open-end fund investing into high flow through (HFT) on-airport logistics real estate throughout North America; Realterm Logistics Income Fund (RLIF), an open-end, core-plus fund, and the Realterm Logistics Fund (RLF) series, a closed-end, value-added fund series, both of which invest into HFT surface transportation logistics real estate throughout the U.S.; Realterm Europe Logistics Fund (RELF), a closed-end, value-added fund series investing into HFT logistics real estate throughout Europe; and IndoSpace Logistics Parks (ILP), a closed-end, opportunistic fund series investing into warehouse and logistics real estate throughout the top industrial markets in India.

Peter Lesburg

Managing Director,

Capital Markets & Investor Relation

Phone: 443.321.3535

Email: [email protected]

Balazs Lados

Manager Director & Fund Manager,

Europe

Phone: +31 (20) 888.8818

Email: [email protected]